Accepting debit & credit cards – Xero, Burton Beavan, and your cashflow

Late payment is a huge issue for British businesses with the average invoice being settled 71 days after issue. That’s 71 days where you have VAT payments, wages, supplier payments, and more that you’ve got to find the money for whilst what is rightfully yours is sitting in your customer’s bank account.

It’s an issue that gets us vexed here at Burton Beavan. It gets us vexed not because our customers are bad payers (the exact opposite in fact, thank you) but because we see the pain, upset, and anguish it causes many of our clients who already feel like they have the weight of the world on their shoulders keeping their business up and running.

We wrote our definite guide to how to get clients to pay last August – we invite you to have a look at our “Customers not paying invoices” article right now.

In that article, we recommended that, for invoices that were 21 days or more past due, that…

“For this step, you will need the ability to accept debit or credit cards (if you need to do that in a hurry, try Stripe). Phone up the person responsible for making the payment and ask them to pay the full amount by card otherwise their account is on hold. Your fallback position from this is to offer to take 50% of the payment now on the card, getting their agreement that you can take the rest from the same card in 2 weeks’ time. This will allow your customer to continue using your credit facilities.”

As a firm of accountants, we’ve been recommending to our clients that they accept credit and debit cards as a matter of course for four years now. That’s because we sensed that any previous reluctance there was on the part of businesses to settle their affairs by credit or debit card was rapidly diminishing.

We never had any evidence to back this up, until now…

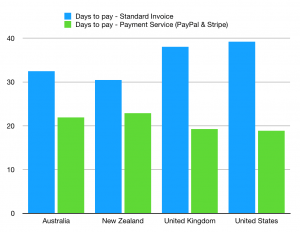

Accepting debit and credit cards – UK businesses pay invoices 19 days faster if offered a credit or debit card option than by standard invoice alone

It was our online bookkeeping partners, Xero, that discovered this by trawling through the hundreds of millions of transactions they keep records of every year.

Xero, Burton Beavan, and your cashflow

In the UK, if a customer was offered a debit or a credit card as means of settlement, an invoice was paid, on average, in 19.26 days. If standard cheque or BACS settlement were the only options offered, an invoice was paid in 38.05 days. That’s half the time.

Accepting debit and credit cards – your Xero account offers the option to collect payment by debit or credit card using Stripe or PayPal

It’s very easy to link up Stripe or PayPal to your Xero online account.

There are no sign-up costs attached to application. You only pay a fee based upon the value of the transactions you put through.

Accepting debit and credit cards – joined-up accounting

Whenever you send out an invoice and you have signed up to either Stripe’s or PayPal’s services, the email and electronic invoice your customer receives will have “Pay Now” buttons on it. The same is true for when you send out reminder emails.

Once the client clicks on that button and enters their credit or debit card details, your Xero will be updated to show that payment has been made. It normally takes between three and five working days for the money to arrive.

At the same time, an invoice from PayPal or Stripe is automatically created with the transaction fee and that invoice is successfully lodged and accounted for in your Xero.

Accepting debit and credit cards – get started

To get our help accepting debit and credit cards via Xero, speak to the Burton Beavan team today on 01606 333900, or email us on hello@burtonbeavan.co.uk