Neil’s Monthly Tax Chat: August 2016

Hello, and welcome to a new feature of the Burton Beavan website, a monthly (will try my best!) chat about tax. I will try to cover a topic in detail, give a summary of latest changes and a summary (note: not in any way plagiarism!) of the latest tax publications. Hopefully my ramblings will be of interest to some of you, obviously the Olympics are on, but you could always give this a read when the boring sports are on!

Most of the queries that we receive from clients start with one or more of a few phrases, namely: Can I?…. How Can I?…How Much?…When?. These questions are normally followed by an apology from lots of clients that they feel the questions might be silly or obvious. Well that is what we are here for, and as I often say I don’t have an inner understanding of all the diverse business activities that you all provide to your clients.

So, if there is a topic that you wish to ask Can I? or How? then ask away, I will start a list of common themes, and if you want to have more detail on how the topics apply to your business and your circumstances please contact your manager in the office.

This month’s topics are the related topics of DIVIDEND TAX CHANGES – EMPLOYERS ALLOWANCE – DIVIDEND WAIVERS. You should have all received a little guide regarding the dividend tax changes I prepared back in March explaining the rules coming in to force for the 2016/17 tax year. Now four months into the tax year it seems a good time to look again.

Dividend Taxation Changes

Back in the July 2015 Budget, in amongst the more headline grabbing announcements regarding the Living Wage and the then quickly reversed changes to Working Tax Credits, was a major change to affect the small-business community: the overhaul of the taxation of dividends.

The changes came into effect from 6th April 2016, and will become evident when you compete your tax returns for the 2016/17 year by 31st January 2018. That last date may seem a long time away, in terms of the payment of the resulting tax liabilities, but with the start date already behind us the importance to act is well upon us.

What are the changes?

- Abolition of the dividend tax credit: dividend income will no longer be grossed up in the personal tax computation. Previously, a tax credit was added to the actual net amount that had been taken as a dividend. A dividend of £10,000 would have shown as £11,111.11 on the Self-Assessment Tax Return (SATR).

- A new dividend tax allowance of £5,000. This does not reduce the taxable income in the way that your personal allowance does, but is a nil rate band applying to the first £5,000 of taxable dividend income.

- Dividends liable to tax in the following bands:

- 0% up to £5,000, then:

- 7.5% within the basic rate band, then:

- 32.5% within the higher rate band, then:

- 38.1% in the additional rate band.

How will this affect you?

The very broad answer is the potential for a tax liability or a higher tax liability. What this means for you individually will depend upon many factors, amongst which:

- Other income you have, employment, pension, rental, savings etc.

- The level of income you require.

- The profitability of your business. Dividends can only be taken from retained profits after tax.

- Level of Directors Loan Account.

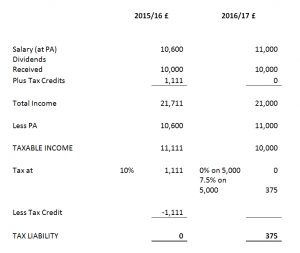

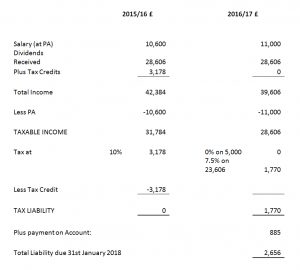

What follows is a few simple examples, which will hopefully give a broad view of the changes. The following examples are all for the years 2015/16 compared with 2016/17.

Example 1: Modest Dividends

This in very basic terms highlights that a tax charge would arise.

Example 2: Dividends at the previous nil rate band

This shows that not only will a tax charge arise, but also as the resulting tax liability is over £1,000, payments on account will be due for the 17/18 year, further increasing the liability.

Employers Allowance

At this stage, for the benefit of the calculations which follow, it is also worth mentioning another change for the 2016/17 year. There has been for several years been an allowance available, whereby a company did not have to pay the first £2,000 of its Employers NI liability. For a director earning £10,600, the Employers NI would have been £350.52, therefore this was covered by the allowance. Not having this liability made it more beneficial to take a salary at the personal allowance rather than the lower level of £8,060, as the saving in Corporation Tax out-weighed the total National Insurance payable.

From this tax year, although the allowance has increased to £3,000 it has been restricted and is now not available to companies where the director is the only person on the payroll. It is also not available if there was another employee who was earning below £8,060, or if a further employee or director is not being paid market rate for their role.

The question of “market rate for their role” is already causing debate on the tax forums and is a grey area.

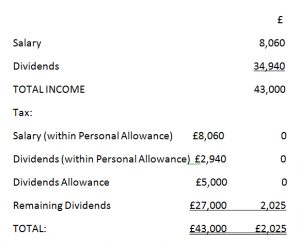

Most of you will already have noticed that due to the restriction of the Employer’s Allowance, the recommended salary that we are processing for 2016/17 is that of £8,060 (£671.67 a month). At this level, there is no National Insurance (employee or employer) to pay, but it is at the level that it still stands as a qualifying year for state pension purposes.

A benefit of this that there is still availability in your personal allowance (this year £11,000) to take a tax free dividend of £2,940. The following is therefore the example provided to many in the response to the query, how much can I take before going into higher rate tax?

Example 3: Dividends up to higher rate tax band

Dividends above this level would be subject to tax at 32.5%.

The tax liability of £2,025, would also result in a payment on account of £1,012.50 also being due, so a total payment would be due of £3,037.50 by 31st January 2018.

Please be wary of the timings of your dividend payments, taking the exactly same amount every month would look very much like a salary payment by HMRC, and if they deemed it to be a salary, the National Insurance and additional tax would be due. To avoid any doubt, raise a dividend voucher for varying amounts in the year and label the bank transaction as a dividend.

What can I do to alleviate the increased tax liabilities?

Back in March I gave the answer to this as: very little really. That does really still stand, if you still require the same level of income from your business, extracting that same level of income will attract a higher level of tax. Deciding to take a higher salary instead of dividends will also be subject to tax, and overall the tax charge will be very similar. There are however a few things you can do.

If you have a Directors Loan Account with a credit balance (ie the company owes you money), you will be able to extract this money as drawings, and this will be tax free. Just be aware that if you extract too much and you then owe the company money, the balance that you owe is subject to Corporation Tax at 32.5% (very much not tax free!).

If you do not need the money in your pocket immediately, but still want to extract money from the company, the money could be placed into a company pension scheme, reducing the Corporation Tax bill, and the personal tax liability. This is one of the most efficient methods of bringing the Corporation tax down.

Use of Dividend Waivers and Classes of Shares

Finally, another consideration that could be applied for those with more than one shareholder is that of different classes of shares and use of a dividend waiver.

When a dividend is declared, everyone with the same class of share is entitled to the same amount of dividend per share. Therefore, two shareholders with equal share (1 share each) declared a dividend of £5,000 per share, then £10,000 would be the dividend figure in the accounts. If there were 5 shares with a 2:3 split, then £25,000 would appear in the accounts and £10,000 and £15,000 on the respective SATRs.

You can set the company up with each shareholder owning a different class of share, meaning although they each owned the same number of shares the dividends declared for each class of share could be different. This is a useful method of balancing the income requirements of each shareholder, who may have differing levels of income from other sources, or may wish to keep their income below a certain level, for instance if in receipt of Child Tax Credits. If you have the same class of share, you ordinarily would have the same dividend per share, unless you declare a dividend waiver.

A dividend waiver, is an agreement between the shareholders that they will not take their entitlement to a dividend. A “deed of waiver” election is required, which is signed, dated, witnessed, this can be applied to a single dividend or a series in a specified time frame. It must also state that the waiver is voluntary and there should be a recorded commercial reason, for example a desire to retain funds in the company (not- to keep my income below a certain level to keep getting Child Tax Credits!).

The same rule remains that dividends can only be paid from the available retained profits in the company, this applies to the total dividends declared, including those waivered, not just the proportion paid. If person A wants to take £10,000 and has 50% of the shares, there must be £20,000 of available profits, even if Person B was waived their right to the dividend and only £10,000 is taken.

The waivers are more useful as a one off, whereby re-organising your shares into different classes gives a more permeant solution.

So, any queries let me or anyone at Burton Beavan know. Send in any topics you think I should cover to nw@burtonbeavan.co.uk, please note if you want an answer to a specific query please email your designated manager or partner. I will be looking at common Corporation Tax planning techniques next month (let the excitement begin!)

All the best,

Neil